personal property tax rate richmond va

Richmond VA 23225 804 230-1212. A collection fee of 30 is added to accounts more than 30 days delinquent.

Dream Of Homeownership Slides Across The Uk Home Ownership New Home Developments Home

Property value 100000 Property Value 100 1000 1000 x 120 tax rate 1200 real estate tax.

. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. It is possible that the portion of the total personal property tax on your vehicle that you have to pay may increase as the number of. Get Record Information From 2021 About Any County Property.

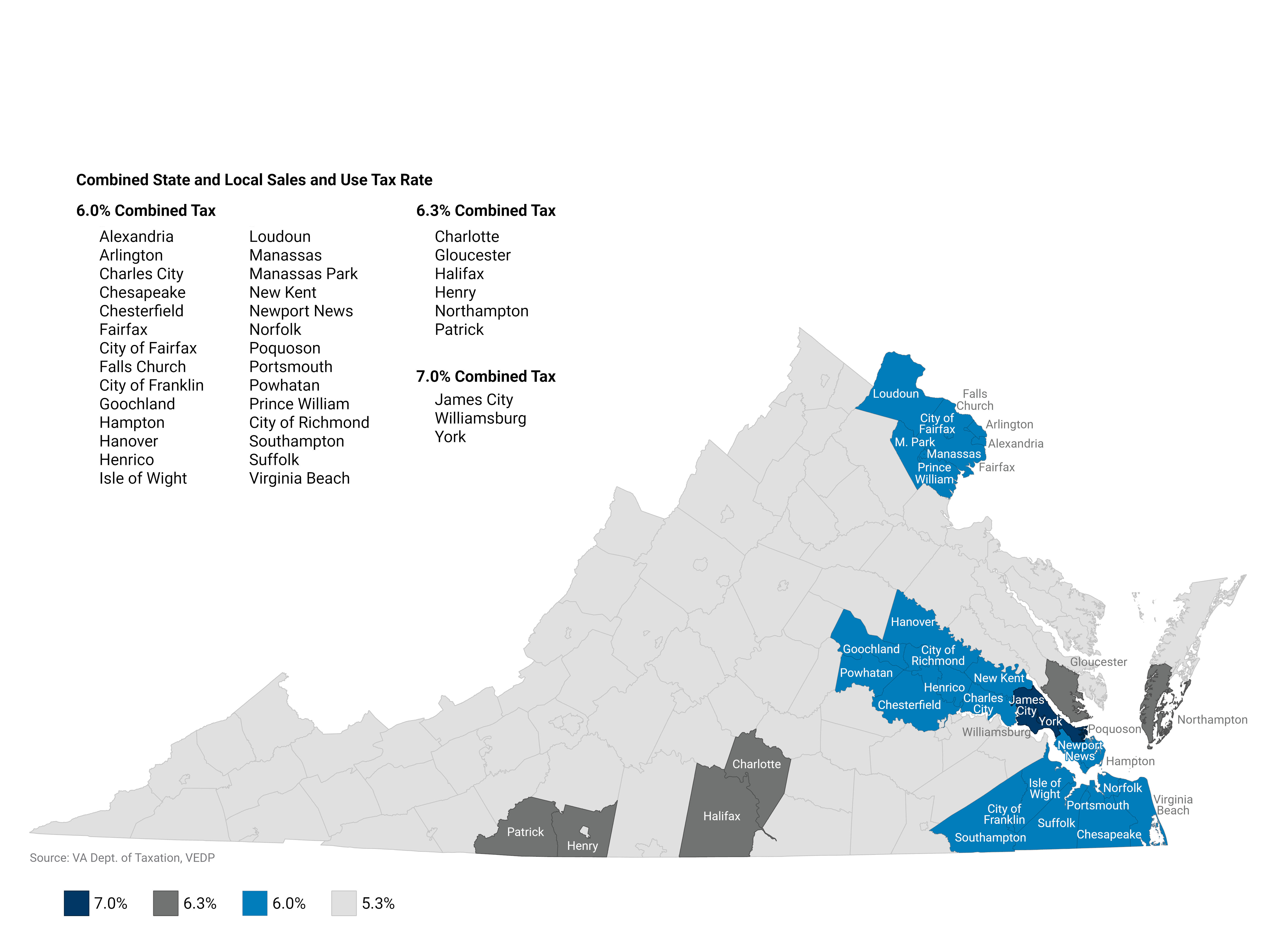

To contact customer service regarding questions about your false alarm bill call toll-free 1-877-893-5267. Car Tax Credit -PPTR. Tax rates differ depending on where you live.

Studying this recap youll get a good understanding of real property taxes in Richmond and what you should be aware of when your propertys appraised value is set. Richmond VA 23219 Map it 804646-7000 Hours. Business Tangible Personal Property Tax Return Richmond.

Henricos tax rate is the lowest in the metro area at 350 per 100 of assessed value. The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property. The median property tax in richmond city virginia is 2126 per year for a home worth the median value of 201800.

Personal Property taxes are billed annually with a due date of December 5 th. Meanwhile surrounding jurisdictions in the metro-area have the. Parking Violations Online Payment.

Click Here to Pay Parking Ticket Online. The 10 late payment penalty is applied December 6 th. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill.

Ad Unsure Of The Value Of Your Property. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. Vehicle License Tax Vehicles.

Personal Property Registration Form An ANNUAL. Personal Property Taxes are billed once a year with a December 5 th due date. Business Tangible Personal Property Tax Return2021 2pdf.

The tangible personal property tax is a tax based on the value of the property commonly referred to as an ad valorem tax. 2 days agoand last updated 120 PM May 11 2022. Manufacturers do not pay tax on purchases used for production.

Real Estate Taxes. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established by Richmond City Council. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles.

Map to City Hall. Distributors do not pay tax on items purchased for resale. Vehicle License Tax Antique.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Other Useful Sources of Information Regarding False Alarm Fees. TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE.

City Code - Sec. The Local Tax Rates Survey is published by the Department of Taxation as a convenient reference guide to selected local tax rates. As of December 31 st of the year preceding the tax year for which assistance is requested the.

Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date. To visit the site register your alarm or make a payment visit Cry Wolf. Personal Property Taxes.

If you live in Chesterfield County you may have noticed a spike in personal property taxes especially when it comes to your car. Local taxes personal property taxes and real estate taxes are. Interest is assessed as of January 1 st at a rate of 10 per year.

If you have questions about your personal property bill or would like to discuss the value. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of the year preceding the year for which assistance in required. Find All The Record Information You Need Here.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Administrative fees are added for most collection processes liens garnishments registration holds judgments etc VA Code 581-3916. The City Assessor determines the FMV of over 70000 real property parcels each year.

If you are contemplating moving there or just planning to invest in the citys property youll come to know whether the citys property tax rules work for you or youd. 2 days agoHenricos personal property tax rate is 350 per 100 of assessed value so the one-time reduction would effectively drop the rate to 298. Pay Your Parking Violation.

2 days agoThe county estimates that residents would receive a 52-cent reduction to their 2022 personal property tax rate as a result. Real Estate and Personal Property Taxes Online Payment. If you have questions about personal property tax or real estate tax contact your local tax office.

Vehicle License Tax Motorcycles. -- Those living in Henrico County will have more time to pay the first installment of their personal property tax bills after a vote on. Parking tickets can now be paid online.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Map of Traffic Hazards. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in.

Call 804 646-7000 or send an email to the Department of Finance. Monday - Friday 8 am. Yearly median tax in Richmond City.

Use the map below to find your city or countys website to look up rates due dates. The rate did not change compared to 2021.

Virginia Historic Tax Credits Tax Credits Historic Properties Historical

Virginia Property Tax Calculator Smartasset

Taxmaster Finance Consulting Psd Template Finance Tax Consulting Business Tax

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Virginia Property Tax Calculator Smartasset

Airbnb Expense Tracker Template Airbnb Spreadsheet Template Etsy Rental Property Management Rental Property Investment Property Management

How To Reduce Virginia Income Tax

Big Change To Credit Scores Could Impact Homebuyers Https Www Floridarealtors Org News Media News Articles 2020 01 B Credit Score Fico Score Bad Credit Score

How To Find The Best Heloc Terms The Dough Roller Home Equity Loan Home Equity Heloc

Monopoly Parker Brothers Real Estate Trading Game No 0009 Hasbro Vintage 1997 Traditional Games Game Sales Home Activities

Mortgage Refinance Calculator Excel Spreadsheet Mortgage Refinance Calculator Refinance Mortgage Refinancing Mortgage

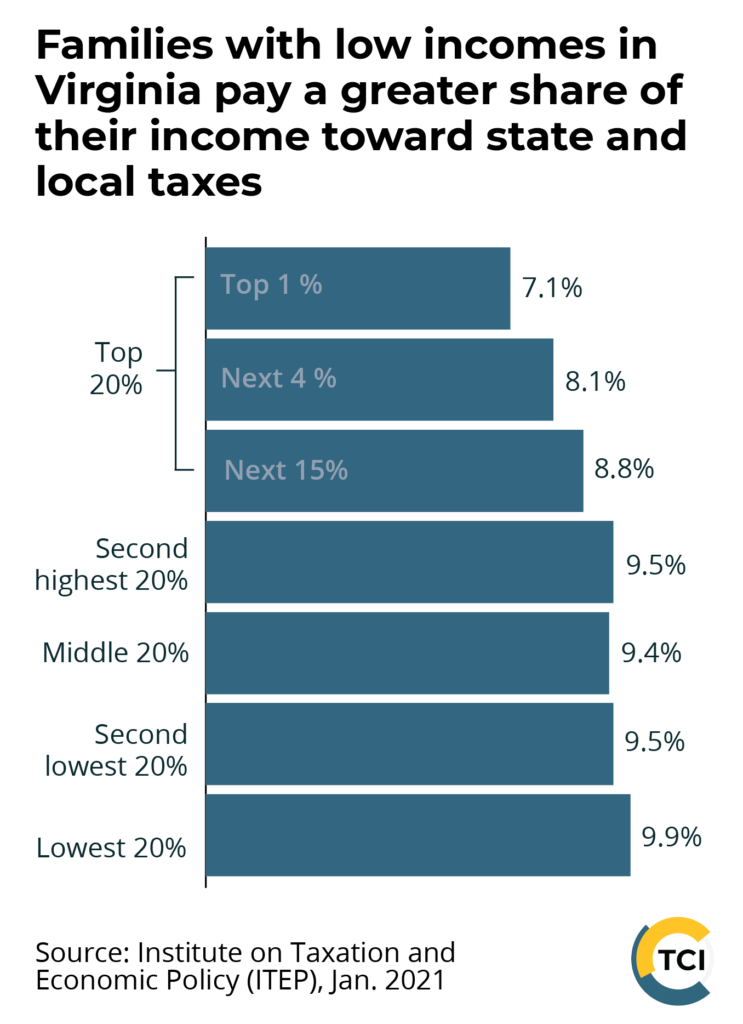

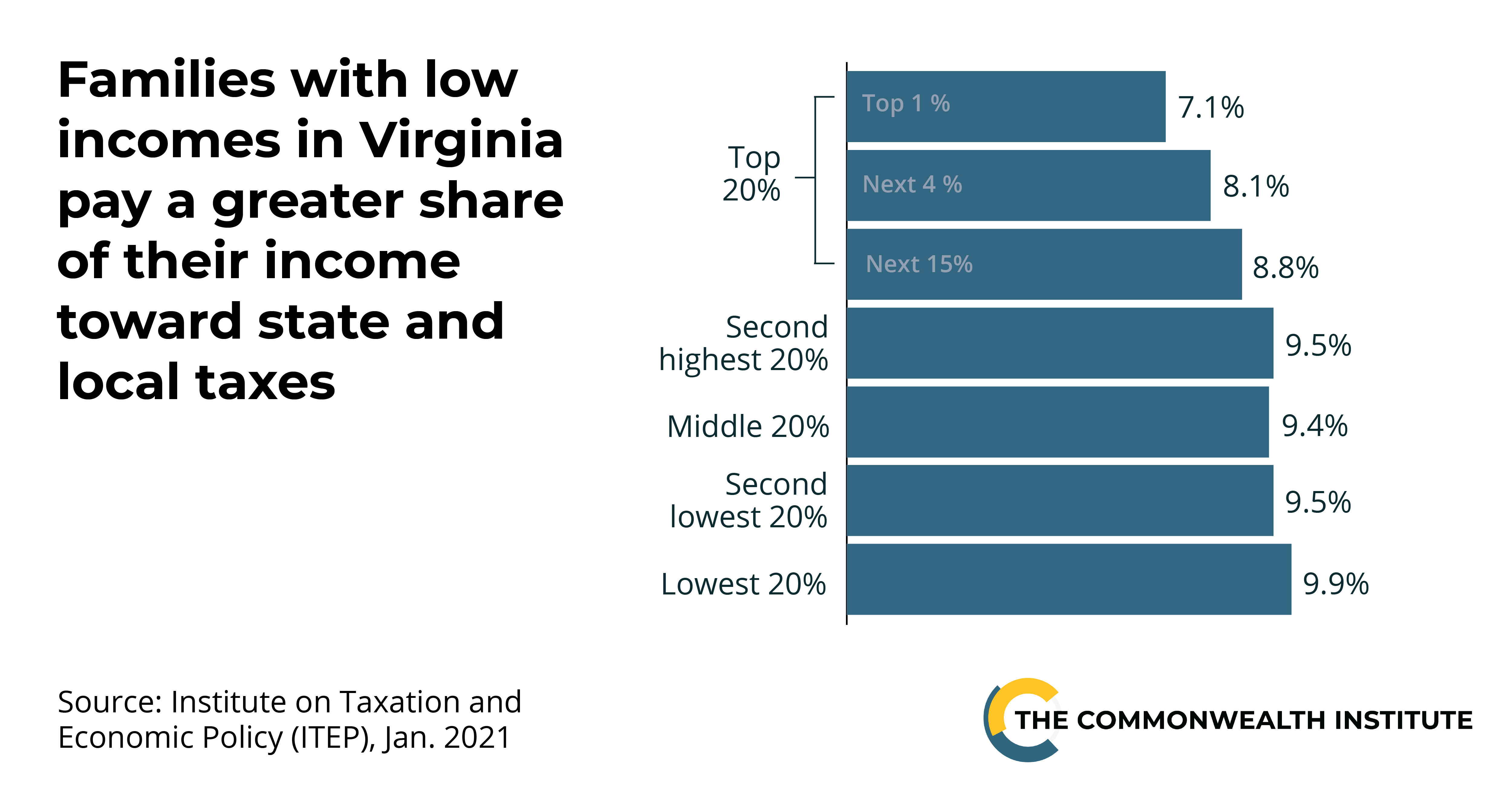

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

021 The Pillars Of Fi Financial Independence Financial Independence Retire Early Smart Money

Pay Online Chesterfield County Va

Pin On Monetary History Investing

Where Residents Pay More In Taxes In Northern Va Wtop News

Mortgage Pre Qualification Checklist Mortgage Mortgage Checklist Home Buying Process

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

The Loan Process 6 Steps Homebridge Financial Services Inc Dean Bendall Mortgage Loan Originator Mortgage Loan Originator Mortgage Loans Mortgage Payoff